Payroll calculation online

Form TD1-IN Determination of Exemption of an Indians Employment Income. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period.

How To Calculate Net Pay Step By Step Example

It will confirm the deductions you include on your.

. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. BTW Payrollmy PCB calculator 2020 is powered by HRmys payroll calculator. Rules for calculating payroll taxes.

A payroll or paycheck calculator is a tool that calculates tax withholdings and other deductions from an employees gross pay which makes it easier to give your employees. To try it out enter the. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Federal Salary Paycheck Calculator. Exempt means the employee does not receive overtime pay.

Enter your employees pay information. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Employers can use it to calculate the net salary the amount they will withhold and the. The net-pay calculator uses the latests PAYE NHIF NSSF values to calculate the net-pay and present it in a simple payslip as it could look in in a typical. 2020 Federal income tax withholding calculation.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Our free payroll tax calculator can easily handle withholding and deductions in any state. Below is a sample payslip generated by HRmy.

On top of a powerful payroll calculator HRmy also offers. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Computes federal and state tax withholding for.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Subtract 12900 for Married otherwise.

Payroll Calculator With Pay Stubs For Excel

Payroll Formula Step By Step Calculation With Examples

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Calculator Free Employee Payroll Template For Excel

15 Free Payroll Templates Smartsheet

Paycheck Calculator Take Home Pay Calculator

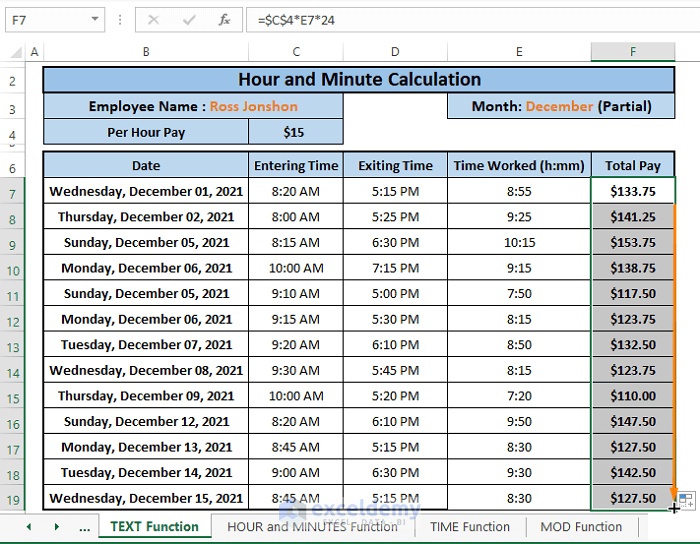

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Payroll Calculator Free Employee Payroll Template For Excel

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates

Paycheck Calculator Take Home Pay Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Pin On Raj Excel